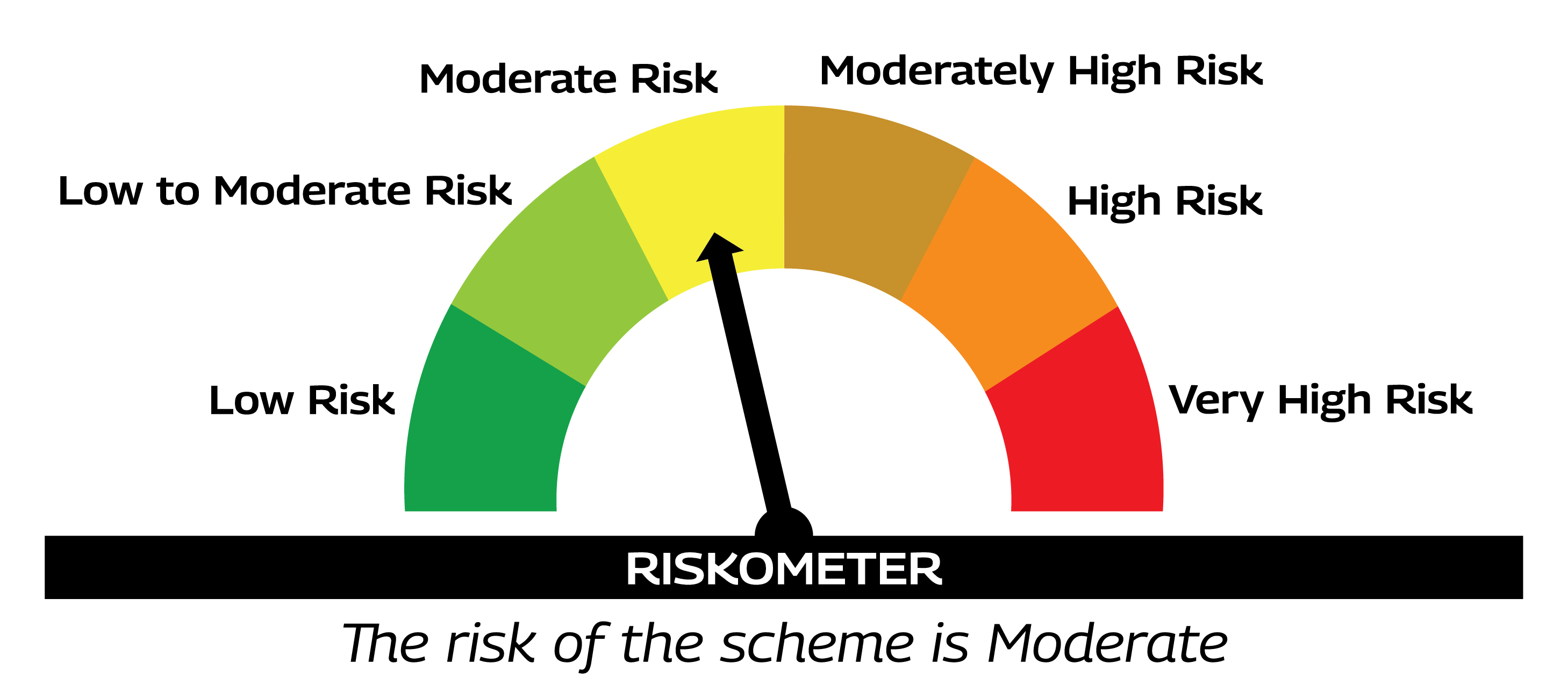

MAHINDRA MANULIFE LIQUID FUND

(An open ended liquid scheme. A relatively low interest rate risk and moderate credit risk.)

|

|

|

|

|

| Data as on 30th, April 2025 | ||||

| Investment Objective | The Scheme seeks to deliver reasonable market related returns with lower risk and higher liquidity through a portfolio of money market and debt instruments. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns. | ||||||||||||||||||||

| Fund Features | Low volatility: Relatively safer during times of high market volatility as liquid funds usually invest in Commercial Papers, Certificate of Deposits, CBLO/ Repos and in short term debt instruments with maturity profile of not more than 91 days. Easy liquidity: Investors can invest in liquid funds even for a day. Cash Management Tool for treasuries of any size: Optimal utilization of idle cash for cash management purposes. |

||||||||||||||||||||

| Fund Manager and Experience | Fund Manager: Mr. Rahul Pal Total Experience: 22 years Experience in managing this fund: 8 years and 10 months (managing since July 04, 2016) Fund Manager: Mr. Amit Garg Total Experience: 19 years Experience in managing this fund: 4 years and 11 months (Managing since June 8, 2020) |

||||||||||||||||||||

| Date of allotment | July 4, 2016 | ||||||||||||||||||||

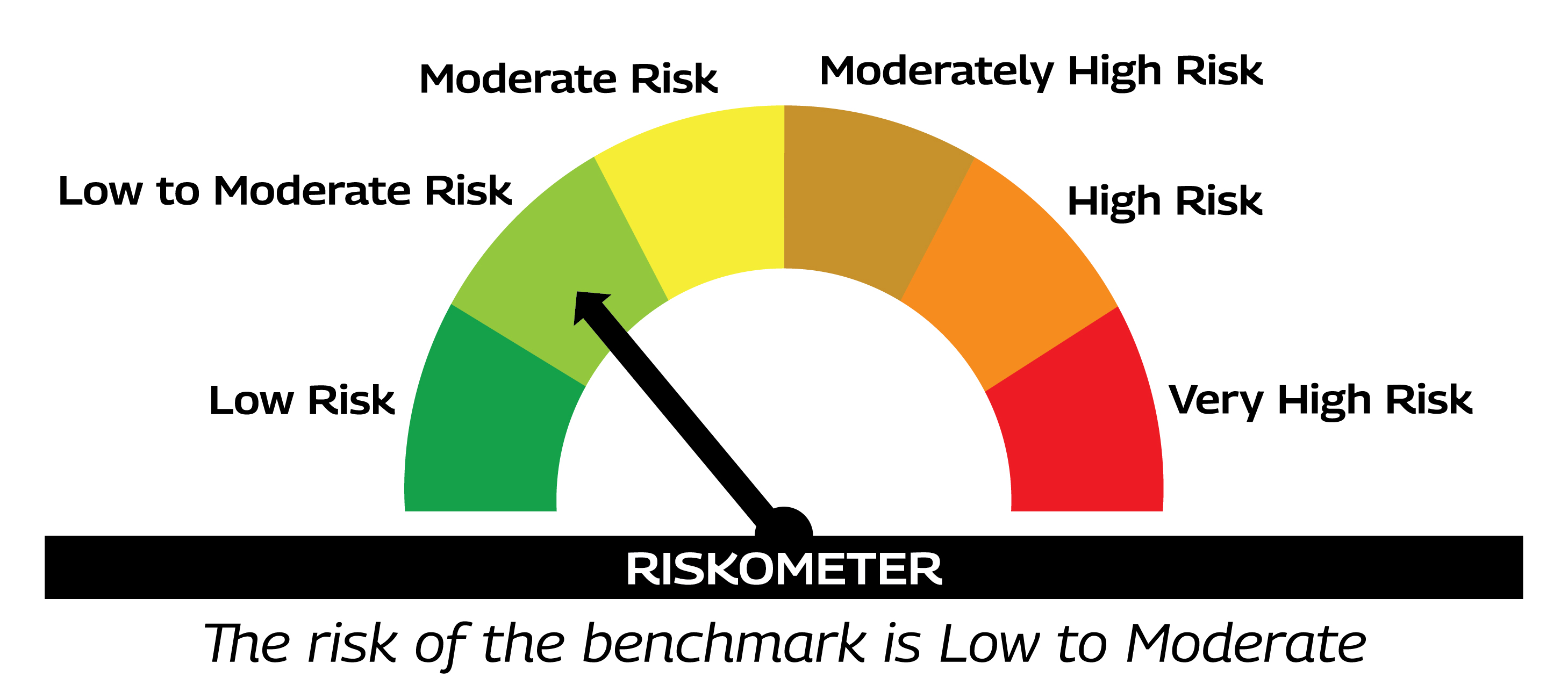

| Benchmark | CRISIL Liquid Debt A-I Index | ||||||||||||||||||||

| Available Plans for subscription by investors | Direct (Default) and Regular | ||||||||||||||||||||

| Available Options under each plan | Growth (Default) and IDCW |

||||||||||||||||||||

| Available Facilities under IDCW Option | IDCW Reinvestment (Daily (Default) and Weekly) | ||||||||||||||||||||

| Minimum Application Amount | Rs. 1,000/- and in multiples of Re. 1/- thereafter | ||||||||||||||||||||

| Minimum Additional Purchase Amount | Rs. 1,000/- and in multiples of Re. 1/- thereafter | ||||||||||||||||||||

| Minimum Repurchase / Redemption Amount | Rs. 1,000/- or 1 unit or account balance, whichever is lower | ||||||||||||||||||||

| Monthly AAUM as on April 30, 2025 (Rs. in Cr.): | 1,613.80 | ||||||||||||||||||||

| Monthly AUM$$ as on April 30, 2025 (Rs. in Cr.): | 1,314.41 | ||||||||||||||||||||

| Total Expense Ratio1 as on April 30, 2025: | Regular Plan: 0.26% Direct Plan: 0.15% 1Includes additional expenses charged in terms of Regulation 52(6A)(b)of SEBI (Mutual Funds) Regulations, 1996 and Goods and Service Tax. |

||||||||||||||||||||

| Load Structure: | Entry Load: N.A. Exit Load:

|

||||||||||||||||||||

| Annualised Portfolio YTM*2: | 6.58% |

| Macaulay Duration: | 49.06 days |

| Modified Duration: | 0.13 |

| Residual Maturity: | 49.15 days |

| As on (Date) | April 30, 2025 |

| *In case of semi annual YTM, it will be annualised 2Yield to maturity should not be construed as minimum return offered by the Scheme |

|

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| Daily IDCW |

1001.0440 |

1195.0696 |

| Weekly IDCW |

1010.3421 |

1003.9436 |

| Growth | 1681.2041 |

1698.9264 |

| IDCW: Income Distribution cum Capital Withdrawal |

||

Issuer |

Rating |

% of Net Assets |

|

|---|---|---|---|

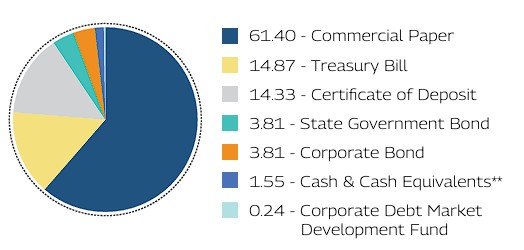

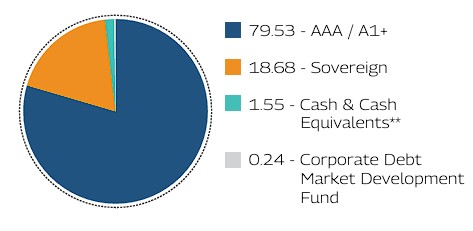

| Certificate of Deposit | 14.33% |

||

| HDFC Bank Limited | CRISIL A1+ | 6.79% |

|

| Bank of Baroda | FITCH A1+ | 5.65% |

|

| Axis Bank Limited | CRISIL A1+ | 1.88% |

|

| Commercial Paper | 61.40% |

||

| National Bank For Agriculture and Rural Development | CRISIL A1+ | 7.54% |

|

| Small Industries Dev Bank of India | CRISIL A1+ | 7.53% |

|

| IGH Holdings Private Limited | CRISIL A1+ | 5.68% |

|

| Tata Housing Development Company Limited | CARE A1+ | 5.67% |

|

| Godrej Properties Limited | ICRA A1+ | 5.64% |

|

| Motilal Oswal Financial Services Limited | CRISIL A1+ | 5.61% |

|

| Reliance Industries Limited | CRISIL A1+ | 3.77% |

|

| Godrej Industries Limited | CRISIL A1+ | 3.74% |

|

| JM Financial Services Limited | CRISIL A1+ | 3.38% |

|

| PNB Housing Finance Limited | CRISIL A1+ | 1.90% |

|

| Nuvama Wealth Management Limited | CRISIL A1+ | 1.89% |

|

| Export Import Bank of India | CRISIL A1+ | 1.89% |

|

| HDFC Securities Limited | ICRA A1+ | 1.89% |

|

| ICICI Home Finance Company Limited | ICRA A1+ | 1.88% |

|

| ICICI Securities Limited | CRISIL A1+ | 1.88% |

|

| 360 One WAM Limited | ICRA A1+ | 1.51% |

|

| Corporate Bond | 3.81% |

||

| Sundaram Home Finance Limited | CRISIL AAA | 3.81% |

|

| Corporate Debt Market Development Fund | 0.24% |

||

| Corporate Debt Market Development Fund Class A2 | 0.24% |

||

| State Government Bond | 3.81% |

||

| 8.14% Maharashtra SDL (MD 27/05/2025) | SOV | 3.81% |

|

| Treasury Bill | 14.87% |

||

| 91 Days Tbill (MD 19/06/2025) | SOV | 3.77% |

|

| 91 Days Tbill (MD 26/06/2025) | SOV | 3.77% |

|

| 91 Days Tbill (MD 05/06/2025) | SOV | 2.65% |

|

| 182 Days Tbill (MD 15/05/2025) | SOV | 1.90% |

|

| 182 Days Tbill (MD 27/06/2025) | SOV | 1.88% |

|

| 91 Days Tbill (MD 15/05/2025) | SOV | 0.47% |

|

| 182 Days Tbill (MD 23/05/2025) | SOV | 0.27% |

|

| 364 Days Tbill (MD 29/05/2025) | SOV | 0.15% |

|

| Cash & Other Receivables | 1.55% |

||

| Grand Total | 100.00% |

||

| ( |

|||

| Mahindra Manulife Liquid Fund | Simple Annualised Returns (%) |

CAGR Returns (%) |

Value of Investment of Rs. 10,000* |

NAV / Index Value (as on April 30, 2025) |

||||||||

| Managed by Mr. Rahul Pal and Mr. Amit Garg | 7 Days |

15 Days |

30 Days |

1 Year |

3 Years |

5 Years |

Since Inception |

1 Year |

3 Years |

5 Years |

Since Inception |

|

| Regular Plan - Growth Option | 5.58 |

5.91 |

6.99 |

7.28 |

6.84 |

5.47 |

6.06 |

10,728 |

12,196 |

13,054 |

16,812 |

1,681.2041 |

| Direct Plan - Growth Option | 5.70 |

6.02 |

7.10 |

7.40 |

6.95 |

5.59 |

6.19 |

10,740 |

12,237 |

13,127 |

16,989 |

1,698.9264 |

| CRISIL Liquid Debt A-I Index^ | 5.74 |

5.90 |

6.95 |

7.21 |

6.84 |

5.54 |

6.01 |

10,721 |

12,199 |

13,093 |

16,743 |

4,280.24 |

| CRISIL 1 Year T-Bill Index^^ | 7.88 |

8.15 |

11.83 |

7.86 |

6.65 |

5.45 |

6.17 |

10,786 |

12,131 |

13,043 |

16,971 |

7,699.79 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 04-Jul-16. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 1,000 invested at inception. The performance details provided above are of Growth Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Mr Amit Garg is managing the scheme since June 8, 2020. For performance details of other schemes managed by the Fund Manager(s), please click here | Best Viewed in Landscape mode

**Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

**Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

|

||||||||||||||