MAHINDRA MANULIFE INCOME PLUS ARBITRAGE ACTIVE FOF

(An open-ended fund of fund scheme predominantly investing in units of

actively managed debt oriented and arbitrage mutual fund schemes)

|

|

|

|

|

| Data as on 30th January 2026 | ||||

| Investment Objective |

The investment objective is to generate long-term

capital appreciation from a portfolio created by

investing in actively managed debt oriented and

arbitrage mutual fund schemes. However, there is no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee/indicate any returns. |

| Fund Features | • Arbitrage scheme aims to provide steady returns

especially during periods of interest rate volatility • Debt allocation aims to focus on extracting maximum yield while maintaining credit quality • The combination of Debt and Arbitrage strategy is tax efficient compared to other fixed income investments especially considering post tax returns (Holding period exceeding 2 years) |

| Fund Manager and Experience | Fund Manager: Mr. Amit Garg Total Experience: 19 years Experience in managing this fund: 2 months (Managing since December 8, 2025) Fund Manager (Debt): Mr Rahul Pal Total Experience: 22 years Experience in managing this fund: 2 months (Managing since December 8, 2025) Fund Manager (Debt): Mr. Mitul Doshi Total Experience: 15 years Experience in managing this fund: 2 months (Managing since December 8, 2025) |

| Date of allotment: | December 5, 2025 |

| Benchmark: | 60% CRISIL Composite Bond Index + 40% Nifty 50 Arbitrage (First Tier Benchmark) |

| Options: | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Amount for Subscription / Purchase: | Rs. 1,000/- and in multiples of Re. 1/- thereafter. |

| Minimum Amount for Switch in: | Rs. 1,000/- and in multiples of Re. 0.01/- thereafter. |

| Minimum Amount for Redemption / Switch-outs: | Rs. 1,000/- or 100 units or account balance, whichever is lower | Minimum Weekly & Monthly SIP Amount: | Rs 500 and in multiples of Re 1 thereafter |

| Monthly AAUM as on January 30, 2026 (Rs.in Cr.): | 30.26 |

| Monthly AUM as on January 30, 2026 (Rs. in Cr.): | 26.51 |

| Total Expense Ratio1 as on January 30, 2026: |

Regular Plan: 0.71% Direct Plan: 0.17% 1Includes additional expenses charged in terms of Regulation 52 (6A) (b) and 52 (6A) (c) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: Nil |

NAV as on January 30, 2026

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 10.0540 |

10.0629 |

| Growth | 10.0540 |

10.0629 |

| IDCW: Income Distribution cum Capital Withdrawal Note: As January 31, 2026 was a non-business day, the NAV disclosed above is as on January 30, 2026. |

||

Company / Issuer |

% of Net Assets |

|

|---|---|---|

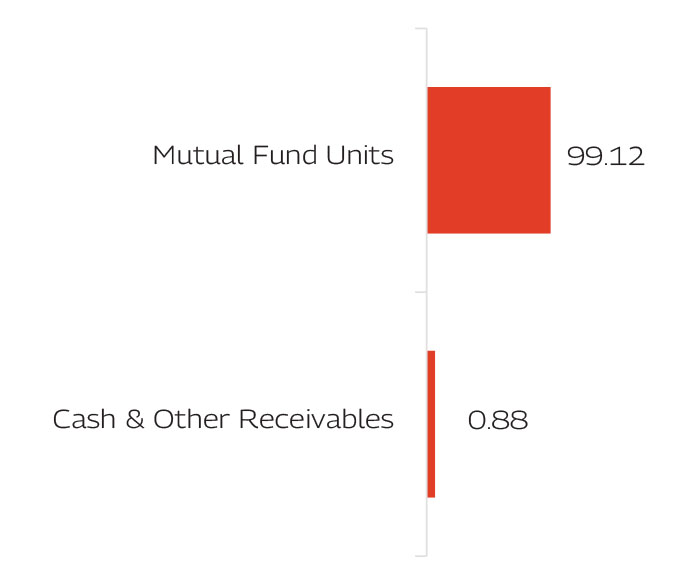

| Mutual Fund Units | 99.12% | |

| Mahindra Manulife Short Durtn Fund - Drct Plan -Gr | 49.00% | |

| Mahindra Manulife Arbitrage Fund - Drct Plan -Gwth | 37.76% | |

| Mahindra Manulife Low Duration Fund - Dir Plan -Gr | 12.36% | |

| Cash & Other Receivables | 0.88% | |

| Grand Total | 100.00% | |

| as on January 30, 2026 |

||

Product Suitability

|

|

| This Product is Suitable for investors who are seeking* | |

|

|

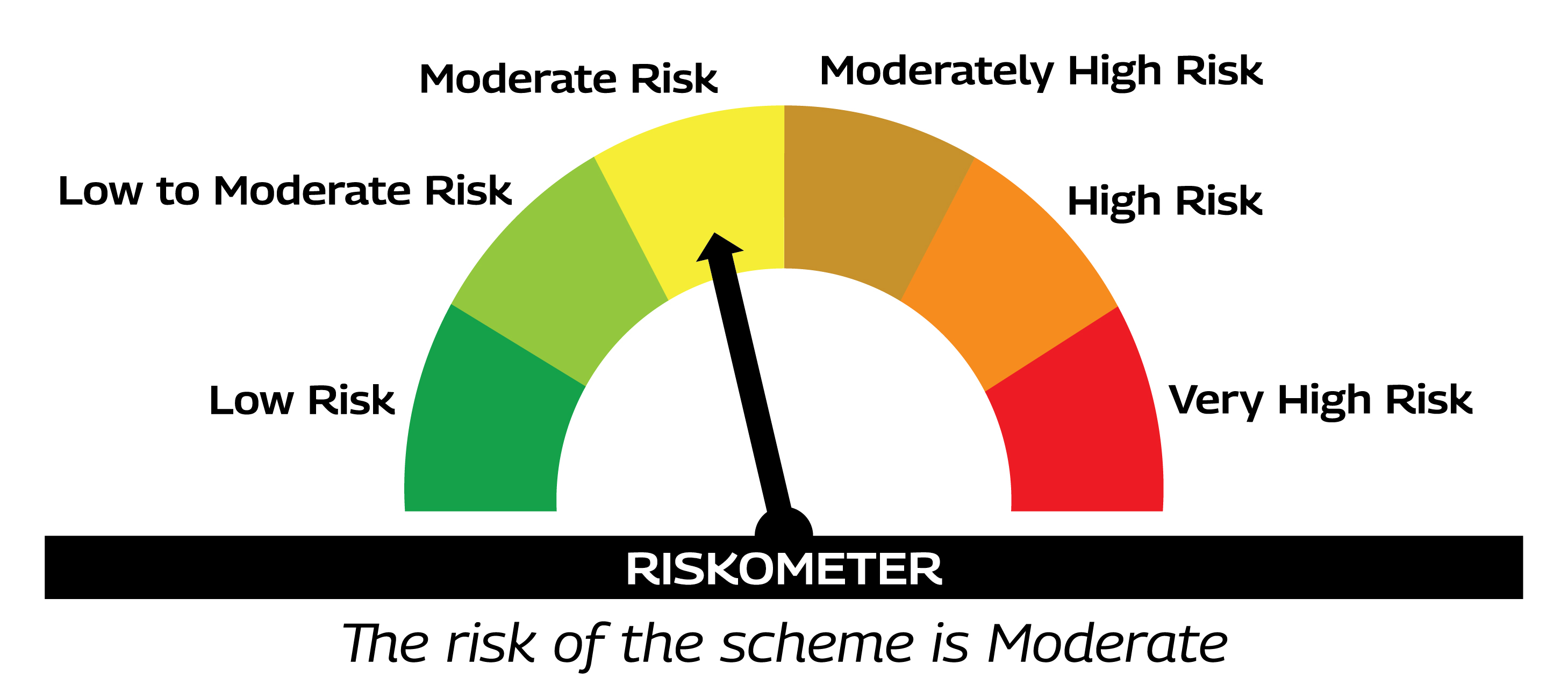

Scheme Riskometers |

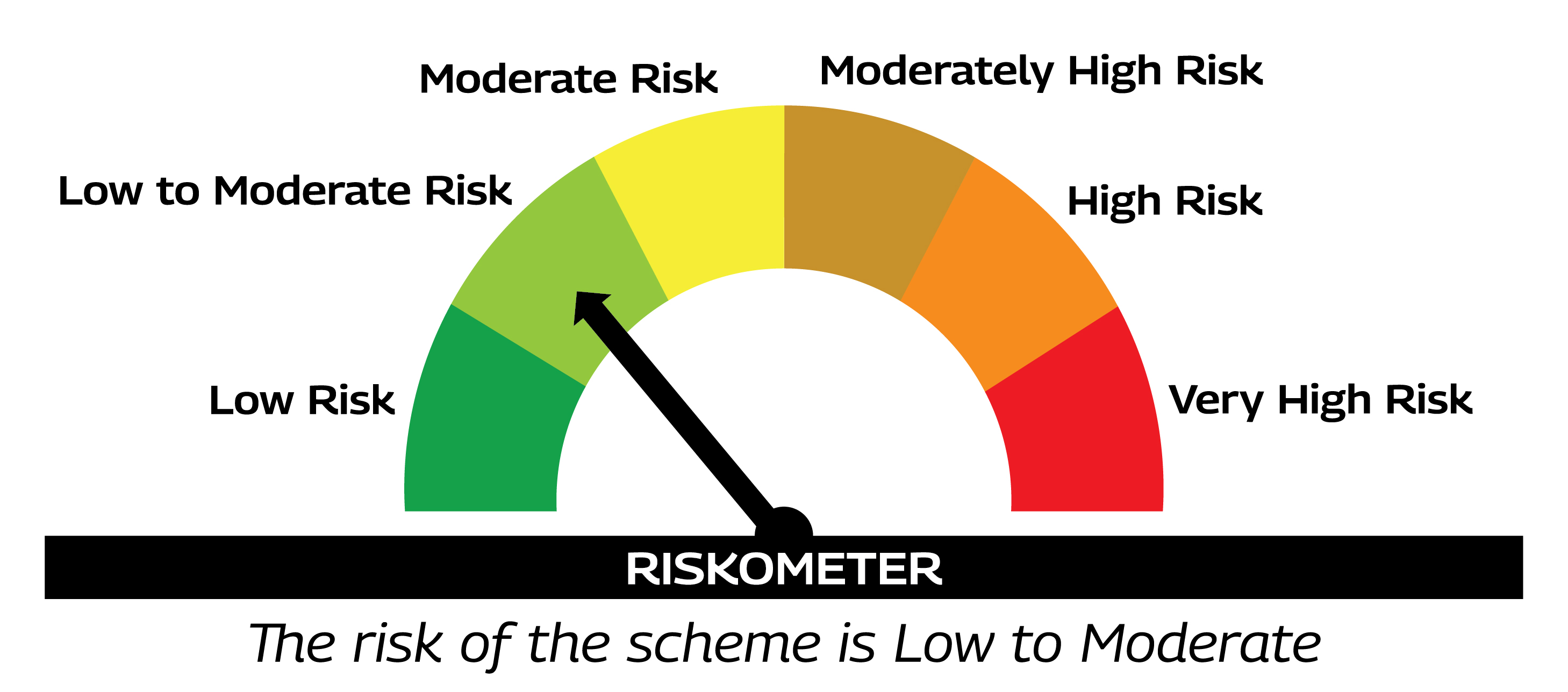

Benchmark Riskometers |

As per AMFI Tier I Benchmark i.e. 60% CRISIL Composite Bond Index + 40% Nifty 50 Arbitrage |

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|