MAHINDRA MANULIFE MANUFACTURING FUND

(An open ended equity scheme following manufacturing theme)

|

|

|

|

|

| Data as on 30th, June 2024 |

||||

| Investment Objective | The Scheme shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in manufacturing theme. However, there is no assurance that the objective of the Scheme will be achieved |

| Fund Features | Government Policies : Policies like Make in India, Atmanirbhar Bharat, Production Linked Incentives etc. could drive manufacturing in India. Global Tailwinds: Diversification of production away from China to avoid supply chain shocks and overdependence could boost manufacturing in India. Improved Infrastructure: Push for improved physical and industrial infrastructure, increased power capacity could be an important enabler for manufacturing. |

| Fund Manager and Experience | Fund Manager: Mr. Renjith Sivaram Total Experience: 13 years Experience in managing this fund: 1 month (Managing since June 24, 2024) Fund Manager: Mr. Manish Lodha Total Experience: 23 years Experience in managing this fund: 1 month (Managing since June 24, 2024) Fund Manager: Mr. Pranav Patel$ Total Experience: 9 years Experience in managing this fund: 1 month (Managing since June 26, 2024) $Dedicated Fund Manager for Overseas Investments |

| Date of allotment | June 24, 2024 |

| Benchmark | BSE India Manufacturing TRI |

| Options | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Application Amount | Rs. 1,000 and in multiples of Re. 1/-

thereafter |

| Minimum Additional Purchase Amount: | Rs. 1,000 and in multiples of Re. 1/- thereafter |

| Minimum Amount for Switch in: | Rs. 1,000/- and in multiples of Re. 0.01/- thereafter. |

| Minimum Amount for Redemption / Switch-outs: | Rs. 1,000/- or 100 units or account balance, whichever is lower in respect of each Option |

| SIP | Minimum Weekly & Monthly SIP Amount: Rs 500 and in

multiples of Re 1 thereafter Minimum Weekly & Monthly SIP Installments: 6 Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Re 1 thereafter Minimum Quarterly SIP installments: 4 |

| Monthly AAUM as on June 30, 2024 (Rs. in Cr.): | 179.17 |

| Quarterly AAUM as on June 30, 2024 (Rs. in Cr.): | 59.07 |

| Monthly AUM as on June 30, 2024(Rs. in Cr.): | 777.78 |

| Total Expense Ratio1 as on June 30, 2024: | Regular Plan: 2.26% Direct Plan: 0.54% 1Includes additional expenses charged in terms of Regulation 52(6A) (b) and 52 (6A) (c) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: 0.5% is payable if Units are redeemed / switched-out on or before completion of 3 months from the date of allotment.; Nil - If Units are redeemed / switched-out after completion of 3 months from the date of allotment. Redemption /Switch-Out of Units would be done on First in First Out Basis (FIFO). Note: The performance data of Mahindra Manulife Manufacturing Fund has not been provided as the scheme has not completed 6 months since inception. The said Scheme is co-managed by Mr. Renjith Sivaram, Mr. Manish Lodha & Mr. Pranav Patel (Dedicated Fund Manager for Overseas Investments) |

NAV as on June 28, 2024

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 10.0545 |

10.0568 |

| Growth | 10.0545 |

10.0568 |

| IDCW: Income Distribution cum Capital Withdrawal As June 29, 2024 and June 30, 2024, were non business days, the NAV disclosed above is as on June 28, 2024. |

||

Issuer |

% of Net Assets

|

|

|---|---|---|

| Automobile and Auto Components | 14.57% |

|

| Samvardhana Motherson International Limited | 2.79% |

|

| Mahindra & Mahindra Limited | 2.77% |

|

| Maruti Suzuki India Limited | 1.92% |

|

| Tata Motors Limited | 1.91% |

|

| Bosch Limited | 1.80% |

|

| Schaeffler India Limited | 1.65% |

|

| CIE Automotive India Limited | 0.96% |

|

| LG Balakrishnan & Bros Limited | 0.63% |

|

| CEAT Limited | 0.14% |

|

| Capital Goods | 6.94% |

|

| Carborundum Universal Limited | 1.63% |

|

| PTC Industries Limited | 1.06% |

|

| Vesuvius India Limited | 1.04% |

|

| Siemens Limited | 0.99% |

|

| Lakshmi Machine Works Limited | 0.98% |

|

| Bharat Electronics Limited | 0.95% |

|

| Inox India Limited | 0.29% |

|

| Chemicals | 1.99% |

|

| Archean Chemical Industries Limited | 1.99% |

|

| Construction | 2.88% |

|

| Larsen & Toubro Limited | 1.92% |

|

| ISGEC Heavy Engineering Limited | 0.96% |

|

| Construction Materials | 3.05% |

|

| Grasim Industries Limited | 2.06% |

|

| Shree Cement Limited | 0.99% |

|

| Fast Moving Consumer Goods | 1.91% |

|

| ITC Limited | 1.91% |

|

| Healthcare | 2.04% |

|

| Divi's Laboratories Limited | 1.06% |

|

| Sun Pharmaceutical Industries Limited | 0.98% |

|

| Metals & Mining | 2.97% |

|

| Hindalco Industries Limited | 1.96% |

|

| Tata Steel Limited | 1.01% |

|

| Oil Gas & Consumable Fuels | 6.19% |

|

| Reliance Industries Limited | 3.14% |

|

| Coal India Limited | 1.03% |

|

| Bharat Petroleum Corporation Limited | 1.02% |

|

| Petronet LNG Limited | 1.00% |

|

| Power | 2.03% |

|

| NTPC Limited | 2.03% |

|

| Equity and Equity Related Total | 44.55% |

|

| Cash & Other Receivables | 55.45% |

|

| Grand Total | 100.00% |

( |

As per the latest Market Capitalisation data provided by AMFI

(In line with the applicable SEBI guidelines)

Product Suitability

|

|

| This Product is Suitable for investors who are seeking* | |

|

|

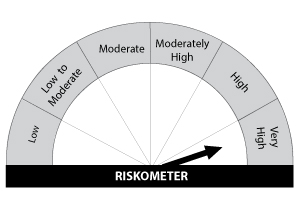

Scheme Riskometers |

Benchmark Riskometers |

Scheme Benchmark: BSE India Manufacturing TRI |

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|