Mahindra Manulife

Small Cap Fund

(Small Cap Fund - An open ended equity scheme predominantly

investing in small cap stocks)

|

|

|

|

|

| Data as on 31st, March 2025 |

||||

| Investment Objective | The investment objective of the Scheme is to generate long term capital appreciation by investing in a diversified portfolio of equity & equity related securities of small cap companies. However, there can be no assurance that the investment objective of the Scheme will be achieved. |

| Fund Features | Potential growth tailwinds in Indian Economy. Opportunity to capitalize on Indian Entrepreneurship. Opportunity to capture market / economic cycles. Potential to create wealth and generate alpha over long-term. Small caps are generally under-researched and under-owned and hence provides an opportunity for stock-picking at reasonable valuations. Small Caps could be beneficiaries of structural reforms announced from time to time. Small caps also provide exposure to companies which are potential market leaders in the industries they operate in (a few examples include textile, paper, sugar, luggage) and have potential to become midcaps of tomorrow as they achieve scale. |

| Fund Manager and Experience |

Fund Manager: Mr. Vishal Jajoo Total Experience: 17 years Experience in managing this fund: 3 months (Managing since December 23, 2024) Fund Manager: Mr. Krishna Sanghavi Total Experience: 27 years Experience in managing this fund: 5 months (Managing since October 24, 2024) Fund Manager: Mr. Manish Lodha Total Experience: 23 years Experience in managing this fund: 2 years and 3 months (Managing since December 12, 2022) |

| Date of allotment | December 12, 2022 |

| Benchmark | BSE 250 Small Cap TRI |

| Options | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Application Amount | Rs. 1,000 and in multiples of Rs. 1/-

thereafter |

| Minimum Additional Purchase Amount: | Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Minimum Weekly & Monthly SIP Amount | Rs 500 and in multiples of Rs 1/- thereafter |

| Minimum Weekly & Monthly SIP installments: | 6 |

| Minimum Quarterly SIP Amount: | Rs 1,500 and in multiples of Rs 1/- thereafter |

| Minimum Quarterly SIP installments: | 4 |

| Monthly AAUM as on March 31, 2025 (Rs. in Cr.): | 3,338.18 |

| Quarterly AAUM as on March 31, 2025 (Rs. in Cr.): | 3467.98 |

| Monthly AUM as on March 31, 2025 (Rs. in Cr.): | 3,463.73 |

| Total Expense Ratio1 as on March 31, 2025: |

Regular Plan: 1.87% Direct Plan: 0.43% 11Includes additional expenses charged in terms of Regulation 52(6A)(b) and 52 (6A)(c)of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: An Exit Load of 1% is payable if Units are redeemed / switched-out upto 3 months from the date of allotment; Nil if Units are redeemed / switched-out after 3 months from the date of allotment. |

| Portfolio Turnover Ratio (Last 1 year): | 0.99 |

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 17.1312 |

17.7952 |

| Growth | 17.1312 |

17.7953 |

| IDCW: Income Distribution cum Capital Withdrawal. |

||

| Note: As March 29, 30 & 31, 2025 was a non-business day, the NAV disclosed above is as on March 28, 2025. | ||

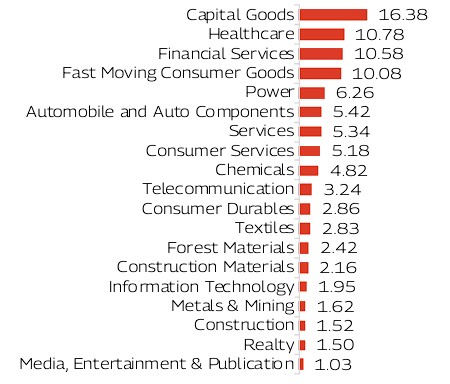

Issuer |

% of Net Assets |

||

|---|---|---|---|

| Automobile And Auto Components | 5.42% |

||

| Minda Corporation Limited | 2.19% |

||

| Varroc Engineering Limited | 1.23% |

||

| TVS Motor Company Limited | 0.78% |

||

| Asahi India Glass Limited | 0.68% |

||

| ZF Commercial Vehicle Control Systems India Limited | 0.45% |

||

| Schaeffler India Limited | 0.09% |

||

| Capital Goods | 16.38% |

||

| APL Apollo Tubes Limited | 3.19% |

||

| Tega Industries Limited | 1.84% |

||

| Kirloskar Brothers Limited | 1.73% |

||

| Bharat Bijlee Limited | 1.50% |

||

| Voltamp Transformers Limited | 1.37% |

||

| Triveni Turbine Limited | 1.11% |

||

| Usha Martin Limited | 1.01% |

||

| Polycab India Limited | 0.98% |

||

| Finolex Industries Limited | 0.93% |

||

| AGI Greenpac Limited | 0.79% |

||

| KEI Industries Limited | 0.71% |

||

| Cummins India Limited | 0.66% |

||

| Swaraj Engines Limited | 0.42% |

||

| LMW Limited | 0.14% |

||

| Chemicals | 4.82% |

||

| PCBL Chemical Limited | 2.10% |

||

| Supreme Petrochem Limited | 1.43% |

||

| Deepak Fertilizers and Petrochemicals Corporation Limited | 1.29% |

||

| Construction | 1.52% |

||

| Kalpataru Projects International Limited | 1.52% |

||

| Construction Materials | 2.16% |

||

| Grasim Industries Limited | 1.13% |

||

| JK Cement Limited | 1.03% |

||

| Consumer Durables | 2.86% |

||

| P N Gadgil Jewellers Limited | 1.29% |

||

| Stove Kraft Limited | 1.00% |

||

| Whirlpool of India Limited | 0.43% |

||

| Kajaria Ceramics Limited | 0.14% |

||

| Consumer Services | 5.18% |

||

| ITC Hotels Limited | 1.84% |

||

| Arvind Fashions Limited | 1.47% |

||

| Trent Limited | 1.17% |

||

| Thomas Cook (India) Limited | 0.69% |

||

| Fast Moving Consumer Goods | 10.08% |

||

| Doms Industries Limited | 2.18% |

||

| Triveni Engineering & Industries Limited | 1.63% |

||

| Mrs. Bectors Food Specialities Limited | 1.48% |

||

| Radico Khaitan Limited | 1.25% |

||

| Adani Wilmar Limited | 1.23% |

||

| Emami Limited | 1.09% |

||

| Godfrey Phillips India Limited | 0.67% |

||

| Jyothy Labs Limited | 0.56% |

||

| Financial Services | 10.58% |

||

| Bajaj Finance Limited | 3.00% |

||

| PNB Housing Finance Limited | 2.21% |

||

| CreditAccess Grameen Limited | 1.24% |

||

| Manappuram Finance Limited | 1.10% |

||

| Karur Vysya Bank Limited | 0.89% |

||

| Central Depository Services (India) Limited | 0.81% |

||

| Cholamandalam Investment and Finance Company Ltd | 0.66% |

||

| Ujjivan Small Finance Bank Limited | 0.61% |

||

| Aadhar Housing Finance Limited | 0.07% |

||

| Forest Materials | 2.42% |

||

| Aditya Birla Real Estate Limited | 2.42% |

||

| Healthcare | 10.78% |

||

| Piramal Pharma Limited | 2.43% |

||

| Laurus Labs Limited | 1.51% |

||

| Max Healthcare Institute Limited | 1.43% |

||

| Divi's Laboratories Limited | 1.25% |

||

| GlaxoSmithKline Pharmaceuticals Limited | 1.16% |

||

| IPCA Laboratories Limited | 1.08% |

||

| Emcure Pharmaceuticals Limited | 0.97% |

||

| Lupin Limited | 0.94% |

||

| Information Technology | 1.95% |

||

| Persistent Systems Limited | 1.00% |

||

| Zensar Technologies Limited | 0.95% |

||

| Media, Entertainment & Publication | 1.03% |

||

| Sun TV Network Limited | 1.03% |

||

| Metals & Mining | 1.62% |

||

| Sarda Energy & Minerals Limited | 1.62% |

||

| Power | 6.26% |

||

| CESC Limited | 2.56% |

||

| NLC India Limited | 1.79% |

||

| JSW Energy Limited | 1.09% |

||

| Inox Green Energy Services Limited | 0.82% |

||

| Realty | 1.50% |

||

| Sobha Limited | 1.00% |

||

| Anant Raj Limited | 0.50% |

||

| Services | 5.34% |

||

| Firstsource Solutions Limited | 2.24% |

||

| eClerx Services Limited | 2.02% |

||

| Sanghvi Movers Limited | 1.08% |

||

| Telecommunication | 3.24% |

||

| Tata Communications Limited | 1.94% |

||

| Bharti Airtel Limited | 1.31% |

||

| Textiles | 2.83% |

||

| Arvind Limited | 1.91% |

||

| Nitin Spinners Limited | 0.92% |

||

| Equity and Equity Related Total | 95.96% |

||

| Cash & Other Receivables | 4.04% |

||

| Grand Total | 100.00% |

||

| ( | |||

| Mahindra Manulife Small Cap Fund | CAGR Returns (%) |

Value of Investment of Rs. 10,000* |

NAV / Index Value (as on March 28, 2025) |

||

| Managed by Mr. Vishal Jajoo, Mr. Krishna Sanghavi & Mr. Manish Lodha | 1 Years |

Since Inception |

1 Year |

Since Inception |

|

| Regular Plan - Growth Option | 5.34 |

26.46 |

10,534 |

17,131 |

17.1312 |

| Direct Plan - Growth Option | 6.93 |

28.57 |

10,693 |

17,795 |

17.7953 |

| BSE 250 Small Cap TRI^ | 5.04 |

20.36 |

10,504 |

15,295 |

7,481.97 |

| Nifty 50 TRI^^ | 6.65 |

12.25 |

10,665 |

13,033 |

35,054.08 |

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 12-Dec-22. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Mr. Krishna Sanghavi is managing this scheme since October 24, 2024. Mr. Vishal Jajoo is managing this fund since December 23, 2024. For performance details of other schemes managed by the Fund Manager(s), please click here | Best Viewed in Landscape mode

Note: As March 29, 30 & 31, 2025 was a non-business day, the schemes returns disclosed are as on March 28, 2025, except for Mahindra Manulife Liquid Fund and Mahindra Manulife Overnight Fund which is as of March 31, 2025.

| Mahindra Manulife Small Cap Fund | Regular Plan |

Direct Plan |

BSE 250 Small Cap TRI^ |

Nifty 50 TRI^^ |

|||||

| SIP Investment Period | Total Amount Invested (  ) ) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

| 1 Year | 1,20,000 |

1,08,425 |

-17.78 |

1,09,267 |

-16.52 |

1,08,523 |

-17.63 |

1,19,270 |

-1.15 |

| 3 Years | 3,60,000 |

4,25,627 |

14.00 |

4,55,736 |

16.04 |

4,43,560 |

14.13 |

4,32,090 |

12.31 |

| 5 Years | NA |

NA |

NA |

NA |

NA |

NA |

NA |

NA |

NA |

| Since Inception | 2,80,000 |

3,36,449 |

16.13 |

3,43,808 |

18.13 |

3,24,309 |

12.78 |

3,19,170 |

11.34 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 12-Dec-22. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other

investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed

after accounting for the cash flow by using the XIRR method (investment internal rate of return). For SIP Performance please click here | Best Viewed in Landscape mode

As per the latest Market Capitalisation data provided by AMFI (In line with the applicable SEBI guidelines)

Product Suitability

|

|

| This Product is Suitable for investors who are seeking* | |

|

|

Scheme Riskometers |

Benchmark Riskometers |

As per AMFI Tier I Benchmark i.e. BSE 250 Small Cap TRI

As per AMFI Tier I Benchmark i.e. BSE 250 Small Cap TRI

|

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|