MAHINDRA MANULIFE MULTI ASSET ALLOCATION FUND

(An open ended scheme investing in Equity, Debt, Gold/Silver

Exchange Traded Funds (ETFs) and Exchange Traded

Commodity Derivatives)

|

|

|

|

|

| Data as on 31st, March 2025 | ||||

| Investment Objective | The investment objective of the Scheme is to seek to generate long-term capital appreciation and income by investing in equity and equity related securities, debt & money market instruments, Gold/Silver ETFs and Exchange Traded Commodity Derivatives (ETCDs) as permitted by SEBI from time to time. However, there can be no assurance that the investment objective of the Scheme will be achieved. |

| Fund Features |

Professional Asset: Allocation Asset Allocation shall be rebalanced regularly by fund managers based on evolving market dynamics Diversified Portfolio: Portfolio that aims to combine stability of fixed income, growth potential of equity and tactical exposure to gold/silver |

| Fund Manager and Experience | Fund Manager (Equity): Mr. Renjith Sivaram Total Experience: 14 years Experience in managing this fund: 1 year (managing since March 13, 2024) Fund Manager (Debt): Mr. Rahul Pal Total Experience: 22 years Experience in managing this fund: 1 year (managing since March 13, 2024) |

| Date of allotment | March 13, 2024 |

| Benchmark | 45% NIFTY 500 TRI + 40% CRISIL Composite Bond Index + 10% Domestic Price of Physical Gold + 5% Domestic Price of Silver |

| Options | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Application Amount | Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Minimum Additional Purchase Amount: | Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Minimum amount for redemption/switch out: | Rs. 1,000/- or 100 units or account balance, whichever is lower |

| SIP | Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Re 1 thereafter Minimum Weekly & Monthly SIP Installments: 6 Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Re 1 thereafter Minimum Quarterly SIP installments: 4 |

| Monthly AAUM as on March 31, 2025 (Rs. in Cr.): | 551.42 |

| Quarterly AAUM as on March 31, 2025 (Rs. in Cr.): | 553.14 |

| Monthly AUM as on March 31, 2025 (Rs. in Cr.): | 566.11 |

| Total Expense Ratio1 as on March 31, 2025: | Regular Plan: 2.03% Direct Plan: 0.40% 1Includes additional expenses charged in terms of Regulation 52(6A)(b) and 52(6A)(c) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: An Exit Load of 0.5% is payable if Units are redeemed / switched-out up to 3 months from the date of allotment; Nil if Units are redeemed / switched-out after 3 months from the date of allotment. Redemption /Switch-Out of Units would be done on First in First out Basis (FIFO) |

| Annualised Portfolio YTM*2^: | 7.33%3 |

| Macaulay Duration^: | 5.97 years3 |

| Modified Duration^: | 5.743 |

| Residual Maturity^: | 10.75 years3 |

| As on (Date) | March 31, 2025 |

| ^For debt component *In case of semi annual YTM, it will be annualised 2Yield to maturity should not be construed as minimum return offered by the scheme; 3Calculated on amount invested in debt securities (including accrued interest), deployment of funds in TREPS and Reverse Repo and net receivable / payable. |

|

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 10.9709 |

11.1650 |

| Growth | 11.2297 |

11.4239 |

| IDCW: Income Distribution cum Capital Withdrawal. |

||

| Note: As March 29, 30 & 31, 2025 was a non-business day, the NAV disclosed above is as on March 28, 2025. | ||

Company / Issuer |

Rating |

% of Net Assets | ||

|---|---|---|---|---|

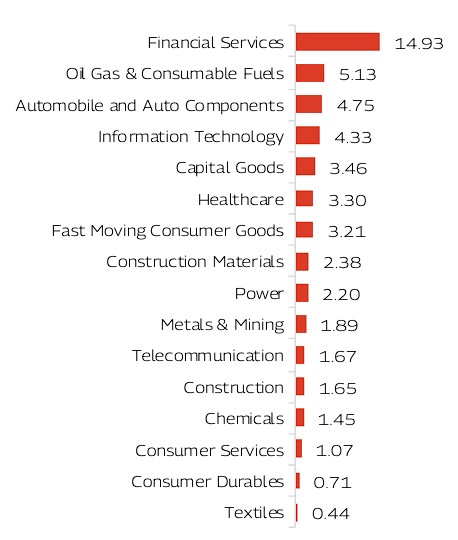

| Automobile And Auto Components | 4.75% |

|||

| Mahindra & Mahindra Limited | 1.34% |

|||

| ZF Commercial Vehicle Control Systems India Limited | 0.81% |

|||

| Hero MotoCorp Limited | 0.62% |

|||

| LG Balakrishnan & Bros Limited | 0.56% |

|||

| Maruti Suzuki India Limited | 0.51% |

|||

| Tata Motors Limited | 0.49% |

|||

| Asahi India Glass Limited | 0.42% |

|||

| Capital Goods | 3.46% |

|||

| PTC Industries Limited | 0.60% |

|||

| Inox India Limited | 0.56% |

|||

| Tega Industries Limited | 0.51% |

|||

| Kirloskar Brothers Limited | 0.49% |

|||

| Carborundum Universal Limited | 0.49% |

|||

| Technocraft Industries (India) Limited | 0.47% |

|||

| KEI Industries Limited | 0.34% |

|||

| Chemicals | 1.45% |

|||

| Coromandel International Limited | 1.08% |

|||

| Archean Chemical Industries Limited | 0.37% |

|||

| Construction | 1.65% |

|||

| Larsen & Toubro Limited | 0.77% |

|||

| Afcons Infrastructure Limited | 0.45% |

|||

| ISGEC Heavy Engineering Limited | 0.43% |

|||

| Construction Materials | 2.38% |

|||

| Shree Cement Limited | 1.00% |

|||

| Grasim Industries Limited | 0.80% |

|||

| JK Cement Limited | 0.57% |

|||

| Consumer Durables | 0.71% |

|||

| Voltas Limited | 0.71% |

|||

| Consumer Services | 1.07% |

|||

| Aditya Vision Ltd | 1.07% |

|||

| Fast Moving Consumer Goods | 3.21% |

|||

| ITC Limited | 1.44% |

|||

| Tata Consumer Products Limited | 0.79% |

|||

| United Spirits Limited | 0.50% |

|||

| Hindustan Unilever Limited | 0.48% |

|||

| Financial Services | 14.93% |

|||

| ICICI Bank Limited | 3.58% |

|||

| HDFC Bank Limited | 3.35% |

|||

| State Bank of India | 1.85% |

|||

| Axis Bank Limited | 1.73% |

|||

| Kotak Mahindra Bank Limited | 1.06% |

|||

| L&T Finance Limited | 0.87% |

|||

| Bajaj Finance Limited | 0.85% |

|||

| SBI Life Insurance Company Limited | 0.77% |

|||

| REC Limited | 0.49% |

|||

| IndusInd Bank Limited | 0.37% |

|||

| Healthcare | 3.30% |

|||

| Divi's Laboratories Limited | 1.73% |

|||

| Sun Pharmaceutical Industries Limited | 1.10% |

|||

| Gland Pharma Limited | 0.47% |

|||

| Information Technology | 4.33% |

|||

| Infosys Limited | 1.12% |

|||

| LTIMindtree Limited | 0.97% |

|||

| Tata Consultancy Services Limited | 0.85% |

|||

| Tech Mahindra Limited | 0.84% |

|||

| Persistent Systems Limited | 0.56% |

|||

| Metals & Mining | 1.89% |

|||

| Tata Steel Limited | 1.02% |

|||

| Hindalco Industries Limited | 0.87% |

|||

| Oil Gas & Consumable Fuels | 5.13% |

|||

| Reliance Industries Limited | 1.62% |

|||

| GAIL (India) Limited | 1.17% |

|||

| Coal India Limited | 0.69% |

|||

| Hindustan Petroleum Corporation Limited | 0.64% |

|||

| Oil & Natural Gas Corporation Limited | 0.56% |

|||

| Petronet LNG Limited | 0.46% |

|||

| Power | 2.20% |

|||

| NTPC Limited | 1.59% |

|||

| Power Grid Corporation of India Limited | 0.61% |

|||

| Telecommunication | 1.67% |

|||

| Bharti Airtel Limited | 1.67% |

|||

| Textiles | 0.44% |

|||

| S. P. Apparels Limited | 0.44% |

|||

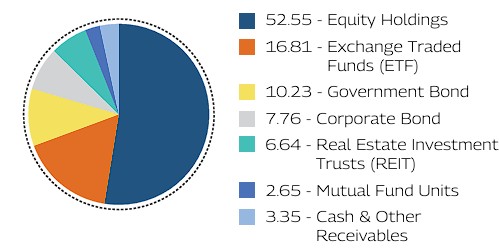

| Equity and Equity Related Total | 52.55% |

|||

| Real Estate Investment Trusts (REIT) | 6.64% |

|||

| Brookfield India Real Estate Trust | Realty | 2.53% |

||

| Embassy Office Parks REIT | Realty | 2.10% |

||

| Nexus Select Trust - REIT | Realty | 2.01% |

||

| Exchange Traded Funds (ETF) | 16.81% |

|||

| Nippon India Silver ETF | 10.42% |

|||

| ICICI Prudential Gold ETF | 6.39% |

|||

| Corporate Bond | 7.76% |

|||

| Muthoot Finance Limited | CRISIL AA+ | 4.46% |

||

| Godrej Industries Limited | CRISIL AA+ | 2.41% |

||

| Kotak Mahindra Investments Limited | CRISIL AAA | 0.89% |

||

| Government Bond | 10.23% |

|||

| 6.92% GOI (MD 18/11/2039) | SOV | 5.23% |

||

| 7.09% GOI (MD 05/08/2054) | SOV | 3.25% |

||

| 7.23% GOI (MD 15/04/2039) | SOV | 1.20% |

||

| 7.34% GOI (MD 22/04/2064) | SOV | 0.37% |

||

| 6.79% GOI (MD 07/10/2034) | SOV | 0.18% |

||

| Mutual Fund Units | 2.65% |

|||

| Mahindra Manulife Low Duration Fund - Direct Plan - Growth | Others | 2.65% |

||

| Cash & Net Receivables/(Payables) | 3.35% |

|||

| Grand Total | 100.00% |

|||

| ( |

||||

| Mahindra Manulife Multi Asset Allocation Fund | CAGR Returns(%) |

Value of Investment of Rs. 10,000* |

NAV / Index Value (as on March 28, 2025) |

||

| Managed by Mr. Renjith Sivaram (Equity), Mr. Rahul Pal (Debt) | 1 Year |

Since Inception |

1 Year |

Since Inception |

|

| Regular Plan - Growth Option | 11.00 |

11.78 |

11,100 |

11,230 |

11.2297 |

| Direct Plan - Growth Option | 12.84 |

13.64 |

11,284 |

11,424 |

11.4239 |

| 45% Nifty 500 TRI + 40% CRISIL Composite Bond Index + 10% Domestic Price of Physical Gold + 5% Domestic Price of Silver^ | 11.60 |

13.17 |

11,160 |

11,375 |

11.3749 |

| Nifty 50 TRI^^ | 6.65 |

7.91 |

10,665 |

10,825 |

35,054.08 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 13-Mar-24.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period.

Note: As March 29, 30 & 31, 2025 was a non-business day, the schemes returns disclosed are as on March 28, 2025, except for Mahindra Manulife Liquid Fund and Mahindra Manulife Overnight Fund which is as of March 31, 2025.

| Mahindra Manulife Multi Asset Allocation Fund | Regular Plan |

Direct Plan |

45% Nifty 500 TRI + 40% CRISIL Composite Bond Index + 10% Domestic Price of Physical Gold + 5% Domestic Price of Silver^ |

Nifty 50 TRI^^ |

|||||

| SIP Investment Period | Total Amount Invested (  ) ) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

| 1 Year | 1,20,000 |

1,23,161 |

5.04 |

1,24,243 |

6.79 |

1,23,706 |

5.92 |

1,19,270 |

-1.15 |

| Since Inception | 1,30,000 |

1,34,391 |

6.01 |

1,35,667 |

7.78 |

1,35,081 |

6.97 |

1,30,095 |

0.13 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 13-Mar-24.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business

day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return). | For SIP Performance please click here |

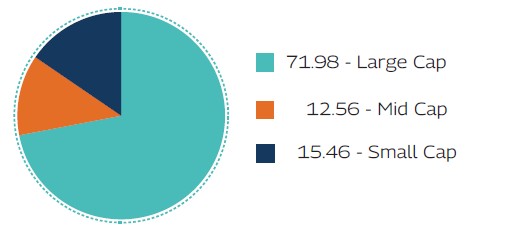

As per the latest Market Capitalisation data provided by AMFI (In line with the applicable SEBI guidelines)

Record Date |

Plan(s) / Option(s) |

IDCW |

Face Value |

Cum-IDCW NAV |

(Rs. per unit) |

(Rs. per unit) |

(Rs. per unit) |

||

13-Mar-25 |

Regular IDCW |

0.25 |

10 |

10.8887 |

13-Mar-25 |

Direct IDCW |

0.25 |

10 |

11.0667 |

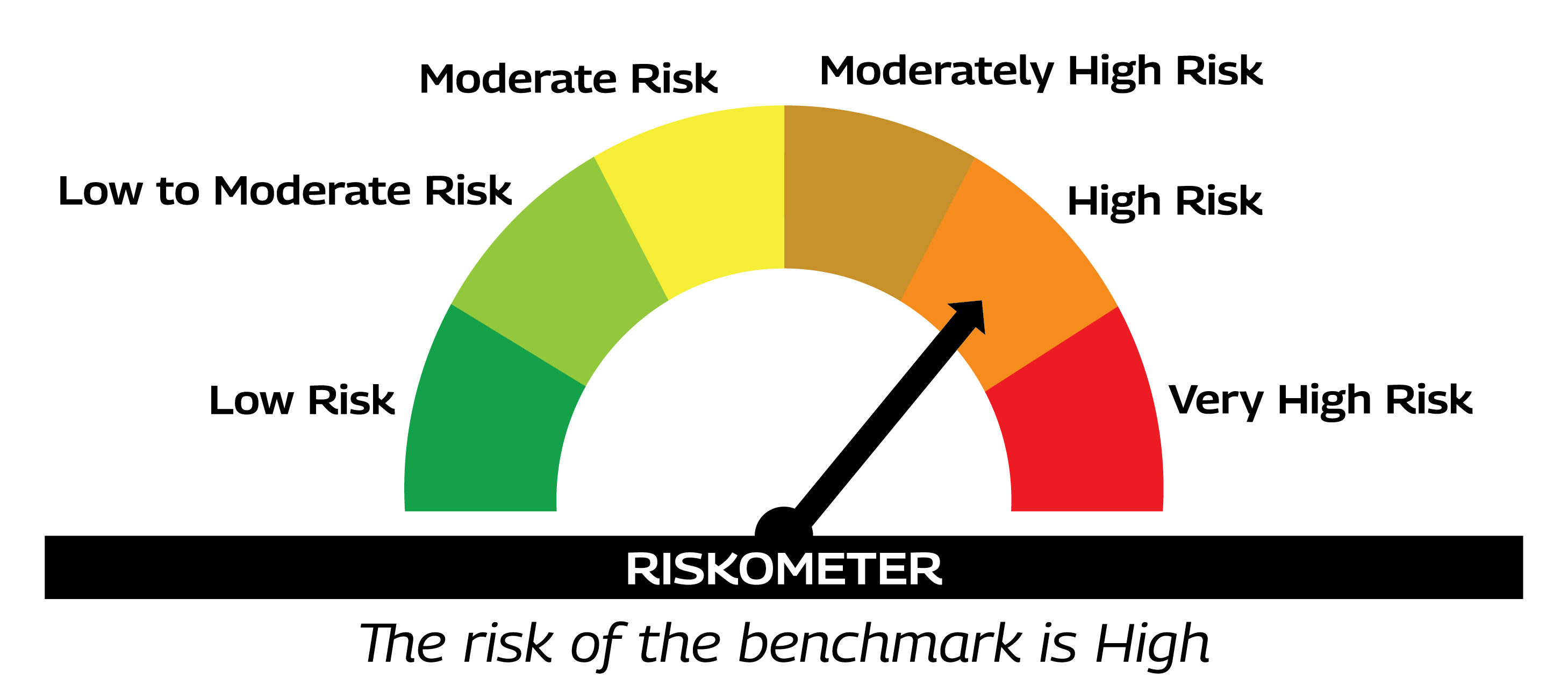

Product Suitability |

|

| This Product is Suitable for investors who are seeking* | |

|

|

Scheme Riskometers |

Benchmark Riskometers |

|

As per AMFI Tier I Benchmark i.e. 45% NIFTY 500 TRI + 40% CRISIL Composite Bond Index + 10% Domestic Price of Physical Gold + 5% Domestic Price of Silver |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|