Mahindra Manulife

Dynamic Bond Fund

An open ended dynamic debt scheme investing across duration. A relatively high interest rate risk and moderate credit risk.

Note: Mahindra Manulife Dynamic Bond Yojana scheme has been renamed as Mahindra Manulife Dynamic Bond Fund w.e.f. March 1, 2023.

| One Pager | February, 2023 |

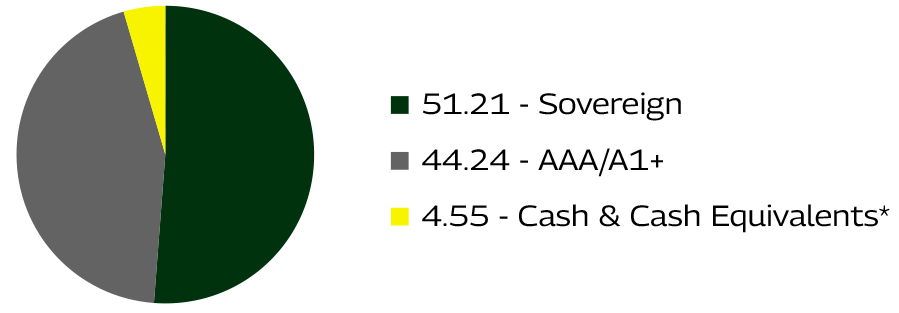

- The Annualised Portfolio YTM of the portfolio is around 7.66%.

- The Modified Duration of the portfolio (MD) increased to around 3.29 years

- The Portfolio largely derives it duration from Gilts as we believe that the AAA credit spreads may expand as we move ahead

| Instruments | Indicative Allocation (% of assets) | Risk Profile | |

| Minimum | Maximum | Low/Moderate/ High | |

| Debt* & Money Market instruments | 0% | 100% | Moderate |

| Units issued by REITs & InvITs | 0% | 10% | Moderately High |

* Includes securitized debt and debt instruments having structured obligations/credit enhancements (such as corporate / promoter guarantee, conditional and contingent liabilities, covenants, pledge and / or Non Disposal Undertaking of shares etc) upto 35% of the net assets of the Scheme.

Benchmark: CRISIL Dynamic Bond Fund BIII IndexEntry Load: N.A.

Exit Load: Nil

FUND MANAGER : MR. RAHUL PAL

Total Experience : 21 years

Experience in managing this fund: 4 years 7 months (managing since August 20, 2018)

Note: The data/statistics given above are to explain general market trends in the securities market, it should not be construed as any research report/research recommendation.

| CURRENT MONTH February 28, 2023 |

|

| AUM (Rs. In Crore) | 66.51 |

| Monthly AAUM (Rs. In Crore) | 67.03 |

| Annualised Portfolio YTM* | 7.66% |

| Macaulay Duration (Years) | 3.45 |

| Modified Duration | 3.29 |

| Residual Maturity (Years) | 4.14 |

| PREVIOUS MONTH January 31, 2023 |

|

| AUM (Rs. In Crore) | 69.55 |

| Monthly AAUM (Rs. In Crore) | 70.07 |

| Annualised Portfolio YTM* | 7.44% |

| Macaulay Duration (Years) | 3.41 |

| Modified Duration | 3.25 |

| Residual Maturity (Years) | 4.17 |

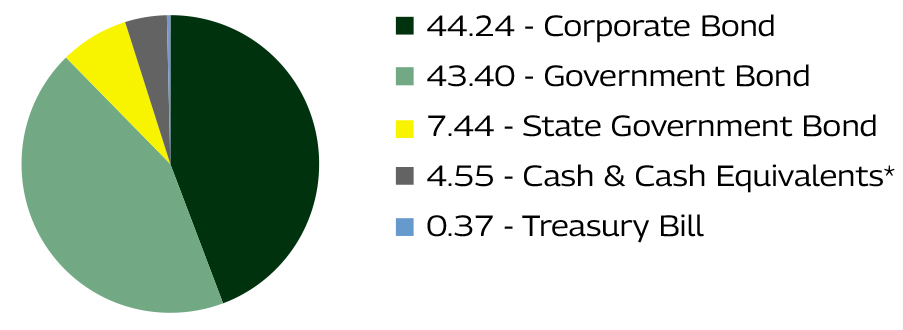

*Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

Data as on 28 Feb 2023

*Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

Data as on 28 Feb 2023

| CURRENT MONTH February 28, 2023 | |

| Security | % to N.A. |

| 7.38% GOI (MD 20/06/2027) (SOV) | 17.93% |

| 7.26% GOI (MD 22/08/2032) (SOV) | 14.77% |

| REC Limited (CRISIL AAA rated CB) | 7.62% |

| Power Finance Corporation Limited (CRISIL AAA rated CB) | 7.50% |

| 7.39% Maharashtra SDL (MD 09/11/2026) (SOV) | 7.44% |

| Small Industries Dev Bank of India (CRISIL AAA rated CB) | 7.43% |

| National Bank For Agriculture and Rural Development (CRISIL AAA rated CB) | 7.40% |

| Housing Development Finance Corporation Limited (CRISIL AAA rated CB) | 7.22% |

| 5.22% GOI (MD 15/06/2025) (SOV) | 7.16% |

| LIC Housing Finance Limited (CRISIL AAA rated CB) | 7.07% |

| TOTAL | 91.56% |

| PREVIOUS MONTH January 31, 2023 | |

| Security | % to N.A. |

| 7.26% GOI (MD 22/08/2032) (SOV) | 17.85% |

| 5.74% GOI (MD 15/11/2026) (SOV) | 10.27% |

| REC Limited (CRISIL AAA rated CB) | 7.36% |

| Power Finance Corporation Limited (CRISIL AAA rated CB) | 7.22% |

| 7.39% Maharashtra SDL (MD 09/11/2026) (SOV) | 7.20% |

| Small Industries Dev Bank of India (CRISIL AAA rated CB) | 7.18% |

| National Bank For Agriculture and Rural Development (CRISIL AAA rated CB) | 7.15% |

| Housing Development Finance Corporation Limited (CRISIL AAA rated CB) | 6.94% |

| 5.22% GOI (MD 15/06/2025) (SOV) | 6.90% |

| LIC Housing Finance Limited (CRISIL AAA rated CB) | 6.80% |

| TOTAL | 84.88% |

| SYSTEMATIC INVESTMENT PLAN |

| WITH THIS YOU CAN • Build corpus in the long term • Take advantage of rupee cost averaging • Experience the power of compounding even on small investments |

| CHOICE OF FREQUENCIES • Weekly • Monthly • Quarterly |

| CHOICE OF DATES Any date of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 6 instalments of ₹ 500 each under weekly frequency • 6 instalments of ₹ 500 each under monthly frequency • 4 instalments of ₹ 1500 each under quarterly frequency |

| SYSTEMATIC TRANSFER PLAN |

| WITH THIS YOU CAN • Take measured exposure into a new asset class • Rebalance your portfolio |

| CHOICE OF FREQUENCIES • Daily • Weekly • Monthly • Quarterly |

| CHOICE OF DATES Any date^ of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 6 instalments of ₹500 each under daily, weekly and monthly frequency • 4 instalments of ₹1500 each under quarterly frequency |

| SYSTEMATIC WITHDRAWAL PLAN |

| WITH THIS YOU CAN • Meet regular expenses |

| CHOICE OF FREQUENCIES • Monthly • Quarterly • Half-Yearly & Annual |

| CHOICE OF DATES Any date of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 2 instalments of ₹ 500 each under monthly / quarterly / Half-Yearly & Annual frequency |

^STP can be registered for any date under the monthly and quarterly frequencies and for any business day under the weekly frequency.

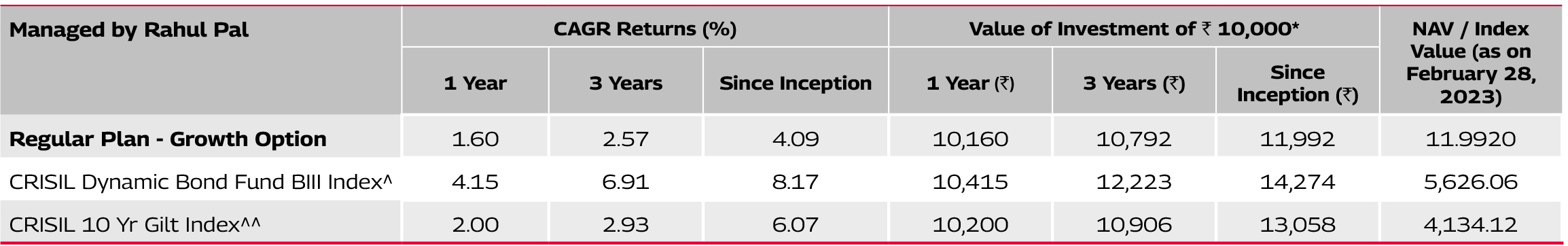

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 20-Aug-18.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period.

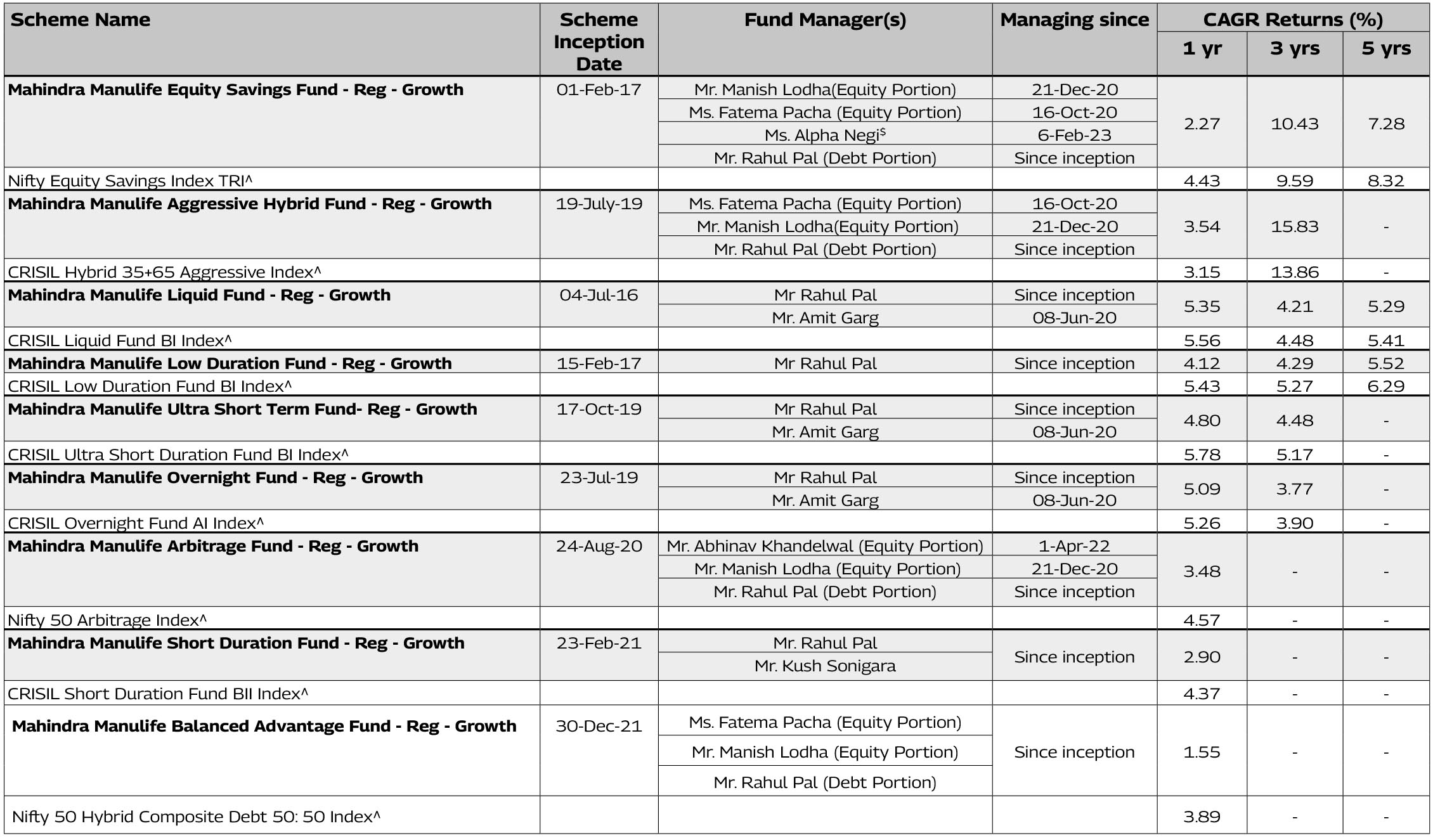

^Benchmark CAGR – Compounded Annual Growth Rate.$Dedicated Fund Manager for Overseas Investments

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Rahul Pal manages 10 schemes of Mahindra Manulife Mutual Fund. The performance data for the schemes which have not completed one year has not been provided.

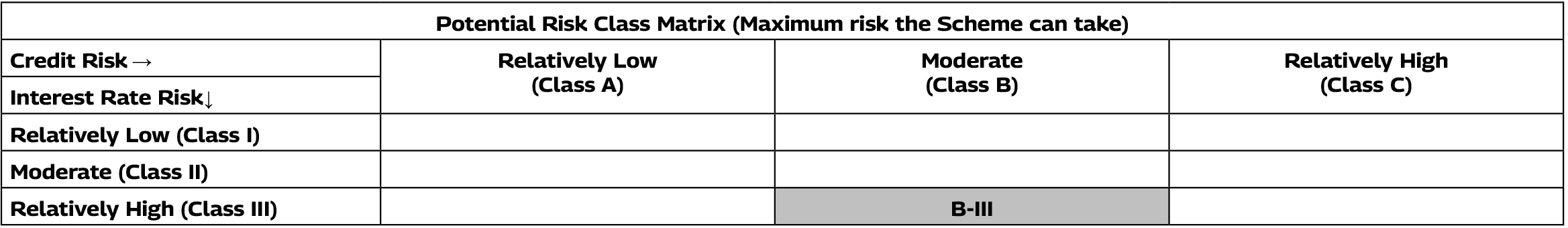

Matrix for debt schemes based on Interest Rate Risk and Credit Risk is as follows:

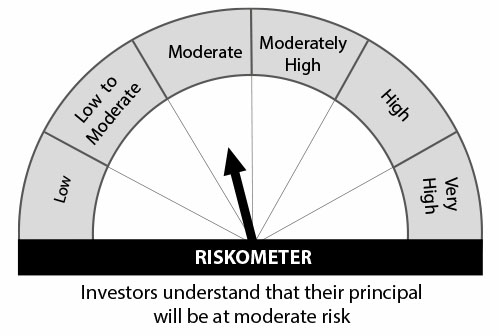

Mahindra Manulife Dynamic Bond Fund

This product is suitable for investors who are seeking*:

• To generate regular returns and

capital appreciation through active

management of portfolio.

• Investments in debt & money market instruments across duration.

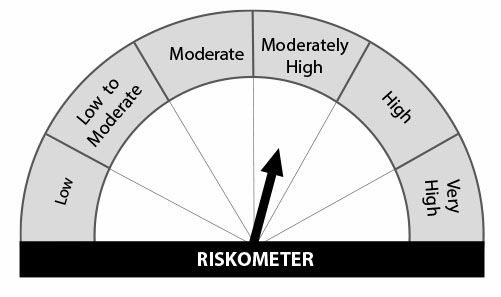

CRISIL Dynamic Bond Fund BIII Index

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Sadhana House, 1st Floor, 570,

P.B. Marg, Worli, Mumbai - 400 018, India.

Phone: +91-22-66327900, Fax: +91-22-66327932

Website: www.mahindramanulife.com