MAHINDRA MANULIFE BANKING & FINANCIAL SERVICES FUND

(An open-ended equity scheme

investing in banking & financial services sector)

|

|

|

|

|

| Data as on 30th January 2026 |

||||

| Investment Objective | The objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in the banking and financial services activities. However, there is no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee/indicate any returns. |

| Fund Features | The scheme endeavours to invest across the sector by

investing primarily in companies within the banking &

financial services sector like the lists given below. This

list is indicative and not exhaustive.

Banks, NBFCs, Housing Finance Companies, Micro Finance Companies, Stock Broking & Allied Entities, Asset Management Company, Depositories, Credit Rating Agencies, Clearing Houses, RTAs, Fintech, Exchanges, Data Platforms, Investment Banking companies, Wealth Management Entities, Insurance Companies |

| Fund Manager and Experience | Fund Manager: Mr. Vishal Jajoo Total Experience: 17 years Experience in managing this fund: 6 months (Managing since July 18, 2025) Fund Manager: Mr. Chetan Sanjay Gindodia Total Experience: 8 years Experience in managing this fund: 6 months (Managing since July 18, 2025) |

| Date of allotment | July 18, 2025 |

| Benchmark | Nifty Financial Services TRI |

| Options | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Application Amount | Rs. 1,000 and in multiples of Re. 1/- thereafter |

| Minimum Additional Purchase Amount | Rs. 1,000 and in multiples of Re. 1/- thereafter |

| SIP | Minimum Weekly & Monthly SIP Amount: Rs 500 and in

multiples of Re 1 thereafter Minimum Weekly & Monthly SIP Installments: 6 Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Re 1 thereafter Minimum Quarterly SIP installments: 4 |

| Minimum Amount for Switch in: | Rs. 1,000/- and in multiples of Re. 0.01/- thereafter. |

| Minimum Amount for Redemption / Switch-outs: | Rs. 1,000/- or 100 units or account balance, whichever is lower in respect of each Option. |

| Monthly AAUM as on January 30, 2026 (Rs. in Cr.): | 396.08 |

| Monthly AUM as on January 30, 2026 (Rs. in Cr.): | 404.91 |

| Total Expense Ratio1 as on January 30, 2026: |

Regular Plan: 2.36% Direct Plan: 0.55% 1Includes additional expenses charged in terms of Regulation 52 (6A) (b) and 52 (6A) (c) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load (as % of NAV): An Exit Load of 0.5% is payable if Units are redeemed / switched-out up to 3 months from the date of allotment; Nil if Units are redeemed / switched-out after 3 months from the date of allotment. Redemption /Switch-Out of Units would be done on First in First Out Basis (FIFO). |

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 10.6970 |

10.8020 |

| Growth | 10.6970 |

10.8020 |

| IDCW: Income Distribution cum Capital Withdrawal. Note: As January 31, 2026 was a non-business day, the NAV disclosed above is as on January 30, 2026. |

||

Company / Issuer |

% of Net Assets |

||

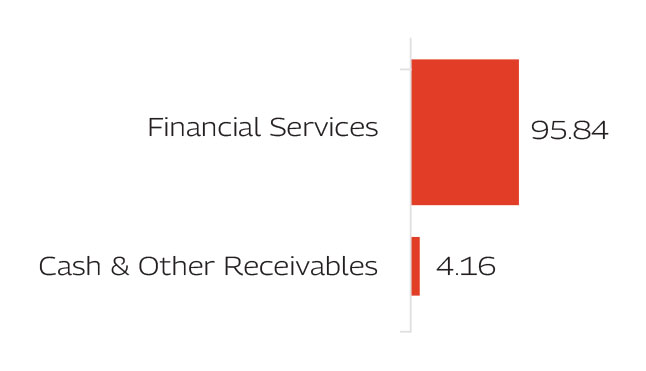

| Financial Services | 95.84% | ||

| ICICI Bank Limited | 13.61% | ||

| HDFC Bank Limited | 12.69% | ||

| Axis Bank Limited | 8.81% | ||

| State Bank of India | 7.82% | ||

| Bajaj Finance Limited | 6.13% | ||

| Kotak Mahindra Bank Limited | 4.18% | ||

| Shriram Finance Limited | 3.29% | ||

| Aditya Birla Capital Limited | 3.15% | ||

| Multi Commodity Exchange of India Limited | 3.10% | ||

| ICICI Prudential Asset Management Company Limited | 2.92% | ||

| Cholamandalam Investment and Finance Company Limited | 2.82% | ||

| Ujjivan Small Finance Bank Limited | 2.78% | ||

| Max Financial Services Limited | 2.34% | ||

| SBI Life Insurance Company Limited | 2.11% | ||

| Equitas Small Finance Bank Limited | 1.90% | ||

| IIFL Finance Limited | 1.54% | ||

| IDFC First Bank Limited | 1.52% | ||

| Tata Capital Limited | 1.37% | ||

| Karur Vysya Bank Limited | 1.36% | ||

| ICICI Prudential Life Insurance Company Limited | 1.27% | ||

| CreditAccess Grameen Limited | 1.05% | ||

| Indian Bank | 1.05% | ||

| Piramal Finance Limited | 1.03% | ||

| PNB Housing Finance Limited | 1.01% | ||

| Bank of Baroda | 0.93% | ||

| RBL Bank Limited | 0.87% | ||

| DCB Bank Limited | 0.76% | ||

| Prudent Corporate Advisory Services Limited | 0.75% | ||

| ICICI Lombard General Insurance Company Limited | 0.74% | ||

| Bank of Maharashtra | 0.73% | ||

| Aadhar Housing Finance Limited | 0.73% | ||

| Repco Home Finance Limited | 0.61% | ||

| BSE Limited | 0.44% | ||

| Union Bank of India | 0.25% | ||

| Nippon Life India Asset Management Limited | 0.18% | ||

| Equity and Equity Related Total | 95.84% | ||

| Cash & Other Receivables | 4.16% | ||

| Grand Total | 100.00% | ||

| ( |

|||

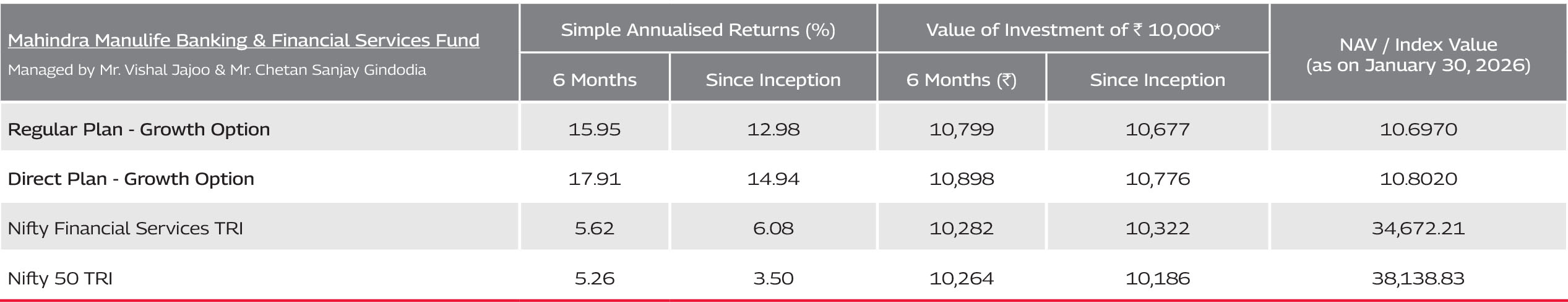

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 18-Jul-25.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

Since inception returns of the

scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different

expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Simple annualized returns have been provided as per the extant guidelines since the scheme has completed 6 months but not 1 year.

please click here | Best Viewed in Landscape mode

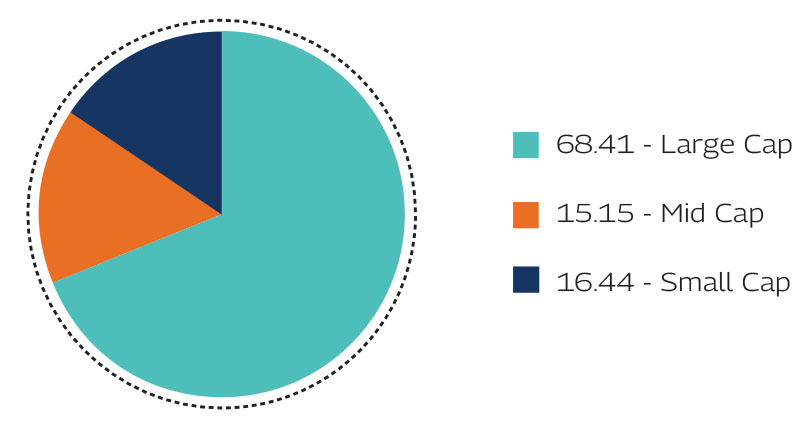

As per the latest Market Capitalisation data provided by AMFI (In line with the applicable SEBI guidelines)

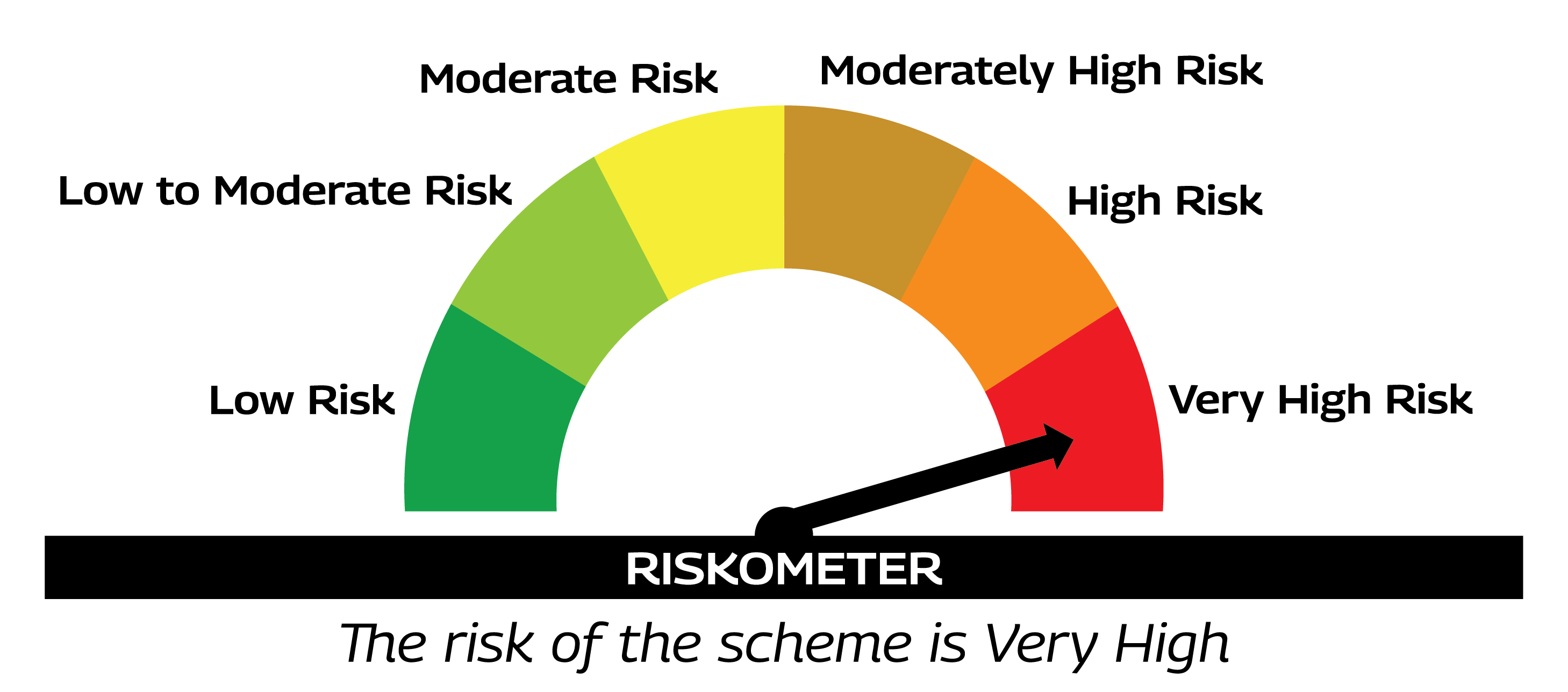

Product Suitability |

|

| This Product is Suitable for investors who are seeking* | |

|

|

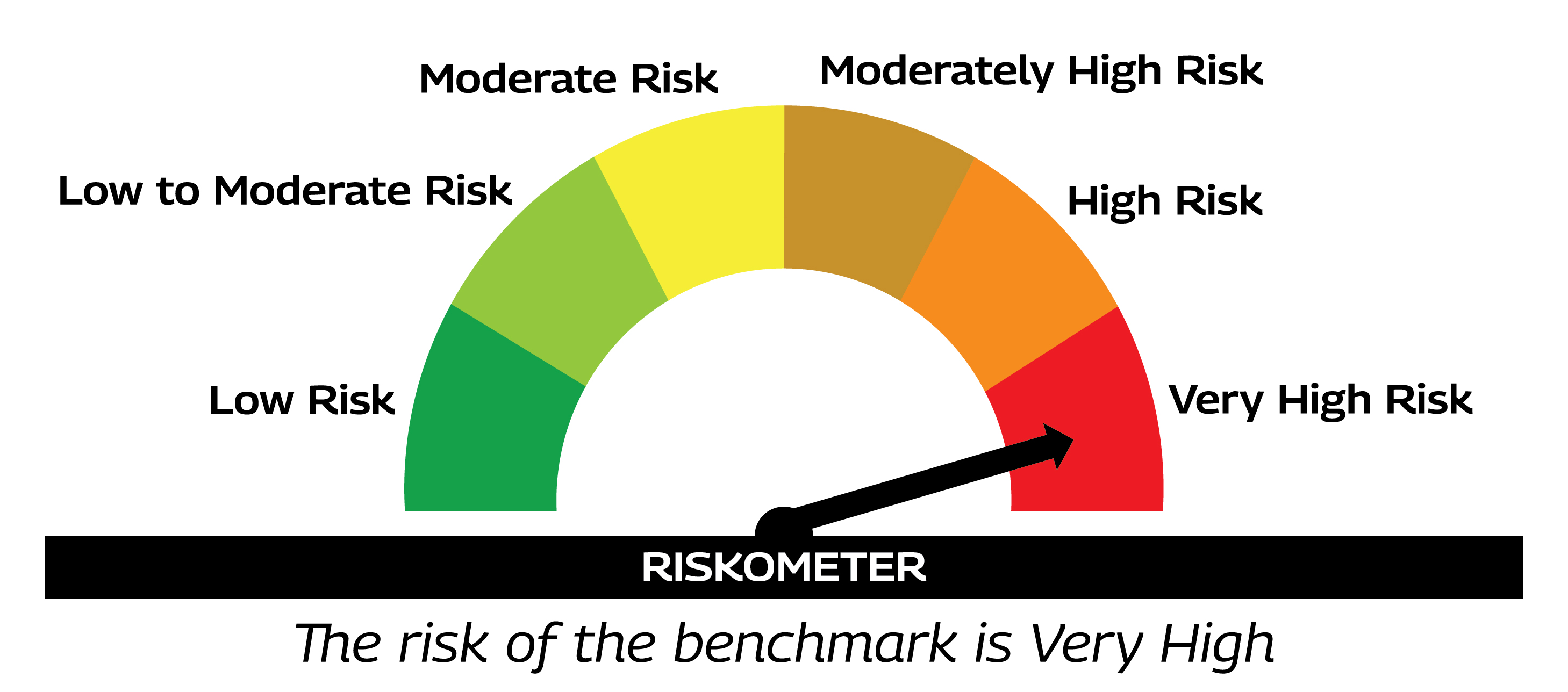

Scheme Riskometers |

Benchmark Riskometers |

As per AMFI Tier I Benchmark i.e. Nifty 500 TRI (First Tier Benchmark) |

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|